Thread: Instaforex Analysis

-

06-11-19, 07:18 #1141

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

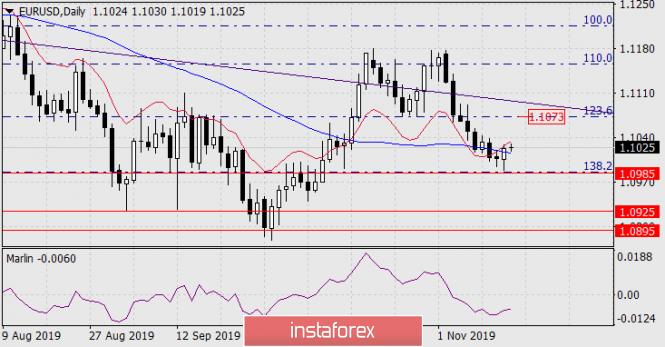

Forecast for EUR/USD on November 6, 2019

EUR/USD

The euro closed the day down by 51 points yesterday. Business media point out the reason for the optimistic sentiment among investors regarding the upcoming US and China trade deal and good October ISM Non-Manufacturing PMI, which rose from 52.6 to 54.7. But with a broad view of the market, it is clear that investors are far from experiencing the interest in risk that was on Friday after the release of US employment data. The Dow Jones stock index grew just 0.11%, while the S&P 500 fell 0.12%. The general mood for dollar purchases remains, and it is characteristic that the price has not reached the levels at which the massive closing of euro purchases began on October 22 and 24, which we spoke about at the time.

The decline in the euro stopped at the Fibonacci level of 123.6% at the lows of October 25-29. There may be a respite before the subsequent downward movement. The signal line of the Marlin oscillator penetrates into the negative trend zone. After a respite, we are waiting for prices to fall to the MACD line at around 1.1027. We admit corrective growth to the price channel line near 1.1104.

The situation is completely declining on the four-hour chart: the price is under the lines of balance and MACD, the Marlin oscillator is developing in the territory of the declining trend.

Analysis are provided by InstaForex

-

11-11-19, 04:52 #1142

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Control zones NZDUSD 11/11/19

The downward movement of the pair is impulsive, as the pair has gone beyond the average weekly movement. This indicates a high likelihood of continued fall and an update of the monthly low. Sales will be profitable after the pair returns to the broken middle course zone. The lower boundary of this zone is at the level of 0.6354.

Work in the downward direction will be a priority at the beginning of the new week. The first goal of the fall will be WCZ 1/2 0.6271-0.6265.

A strong increase in demand is required to break the downward momentum, which will lead to the closure of trading on Monday to be above Friday's Asian session. This will indicate the emergence of a major player interested in the appreciation of the New Zealand dollar.

Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

Analysis are provided by InstaForex

-

13-11-19, 02:52 #1143

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Oil returned to production

Euphoria over the proximity of the agreement between China and the United States to end the trade war pulled up quotes of the Brent and WTI. Nevertheless, it was worth of Donald Trump to say that the issue of the rollback of import duties has not yet been resolved, China will notice an 11.5% increase in black gold imports in October, and Oman will declare at the OPEC+ meeting that the agreement on production cut would be extended in the previous volume, as the bulls in both varieties began to get nervous.

As I noted in several previous materials, the slowdown in shale production in the United States, on the one hand, and the reduction in its volumes by Saudi Arabia, Russia, and other countries, on the other hand, have made the factor in changing global demand as the main driver of pricing. The slowdown in its growth under the influence of trade wars caused oil to fall from April to September, however, as soon as a turning point emerged in relations between Beijing and Washington, the situation changed radically. Speculators began to leave short positions and open long ones, and black gold added about 5% since the beginning of November.

The dynamics of speculative positions and quotes WTI

China is the largest oil consumer in the world, therefore, an increase in its imports in January-October by 10.5% YOY made it possible for investors to raise the logical question: if a trade war does not prevent China from increasing purchases of black gold, is it worth expecting that an agreement between Beijing and Washington will sharply raise prices? It is possible that most of the positive has already been incorporated into the Brent and WTI quotes, so the agreement under Phase 1 will go unnoticed by the players.

Technically, a breakthrough of resistance at $62.6 and $63.6 (Pivot levels) will make it possible for the Brent bulls to continue the rally in the direction of the targets for the Wolfe Wave and Shark patterns. They are located near the marks of $72.1 and $73.8 per barrel. On the contrary, the inability of buyers to storm important levels will increase the risks of declining quotes to $59.3 and $56.3.

Analysis are provided by InstaForex

-

15-11-19, 07:46 #1144

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 40

- Posts

- 112

- Rep Power

- 0

Forecast for EUR/USD on November 15, 2019

On Thursday, due to new difficulties in relations between the United States and China (China is resisting the signing of a clearly unprofitable trade agreement for it), investors chose to close their positions due to the uncertain economic data for Europe and the US that are coming out today, right before strong technical support (1.0985). The price exceeded the MACD line, the Marlin oscillator showed a reversal, but these are not yet sufficient conditions for significant growth, the situation is typical for correction. With the return of the price under the MACD line, the next wave of activity in euro sales is likely. We do not expect a correction above the Fibonacci level of 123.6% (1.1073).

On the four-hour chart, the Marlin signal line entered the growth zone, while the price remains below the MACD line. The exit of the price above the line (1.1035) will allow the euro to develop a correction. This can be prevented by economic indicators; The eurozone trade balance for September is expected today to fall from 20.3 billion euros to 18.7 billion, US retail sales are projected to grow by 0.1% in October from -0.3% in September. Concern is caused by industrial production in the US for October, the forecast is -0.4%.

So, after the correction is over, we are waiting for a new round of euro decline. Overcoming the first support at 1.0985 opens the way to the second goal 1.0925.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

18-11-19, 05:13 #1145

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Control zones USDJPY 11/18/19

The pair tested the WCZ 1/2 108.48-108.38 last Thursday. Consolidation below the zone did not occur, therefore, the upward medium-term impulse remains a priority. The first growth target is the November high. Its achievement will make it possible to close part of the purchases and transfer the rest to breakeven.

Closing Friday trades made it possible to form an absorption pattern of the daily level, which confirms the bullish momentum.

Re-absorption of Friday purchases will be required to implement an alternative option. The probability of this is below 30%, which does not make it possible to consider sales. The main goal of the bullish impulse is the weekly control zone 110.15-109.94, which gives a favorable risk-to-profit ratio for any purchase made from current levels and below. Therefore, it is necessary to consider the possibility of adding to a long position.

Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

Analysis are provided by InstaForex

-

21-11-19, 03:32 #1146

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Trading idea for the AUD/USD pair

Good evening, dear traders! The growth of AUD / USD is what is interesting today. As we remember, unemployment data was published in Australia last week on November 14, to which this instrument reacted negatively: the AUD/USD currency pair was declining throughout the whole day. An important detail is that during the fall, an important extreme at 0.6810 was updated. Thus, I believe that this was a culmination of the downward trend in November, and given the reaction of the Australian dollar to this week's news, I think that local growth is possible to the level of 0.6843, which is the news' high on Wednesday. Now, why exactly this level? It's simple - every seller who believes in a further fall of this instrument will clearly depend precisely on the news impulse on November 14, so the price can go there with a high degree of probability.

Recommendation: try to buy in order to update the level of 0.6943. At the same time, losses can be limited to the lowest level of 0.6788 - there is no sense in holding purchases below, and in case of updating this minimum, the bullish scenario can be considered invalid.

Wishing you all success in trading and huge profits!

Analysis are provided by InstaForex

-

22-11-19, 09:42 #1147

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 40

- Posts

- 112

- Rep Power

- 0

GBP/USD approaching support, potential bounce!

Price is approaching our first support where we are expecting a bounce above this level.

Entry: 1.28978

38.2% Fibonacci retracement, 78.6% Fibonacci extension, horizontal overlap support

Take Profit : 1.29731

Why it's good : 78.6% Fibonacci retracement, horizontal swing high resistance

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

25-11-19, 06:18 #1148

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

GBP/USD approaching resistance, potential drop!

Price is approaching our first resistance a 1.28722 where we are expecting a drop to our first support level at 1.27697.

Entry: 1.28722

23.6% Fibonacci retracement, 61.8% Fibonacci extension, horizontal overlap resistance

Take Profit : 1.27697

Why it's good : horizontal swing low support

Analysis are provided byInstaForex.

-

26-11-19, 03:57 #1149

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Developing USD/CAD pair and trading idea

During the previous recommendation on Friday,it is advised to develop the pair at least on a false breakdown of the level of 1.3269. Actually, this is exactly the outcome we are observing - on the news, this level was falsely broken, and thus, the recommendation completely justified itself. The plan was this:

Thus far, the intrigue of the instrument continues. False news breakdown of this level provides a good opportunity for the development of further medium-term upward trend. Since the end of October, there has been a prolonged upward trend on for this instrument, and the probability of its continuation is still high. For this reason, there is another recommendation for the same instrument today. I believe that the development will continue to a minimum to the level of 1.3326. Therefore, you can try to buy with a goal of updating it, limiting the risks at the price of 1.3254, since it makes no sense to keep purchases below the news last Friday. Updating Friday's minimum - the bullish scenario will be completely canceled.

Wishing you all success in trading and huge profits!

Analysis are provided by InstaForex

-

27-11-19, 06:11 #1150

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Take profit on AUD/USD pair

Good evening, dear traders! Congratulations to those who took advantage of our trading idea for the AUD/USD pair, which was provided last November 25.

Let me remind you that the idea was to develop the lower daily area in a downward trend:

As you can see, the first goal is taken:

The collapse did not follow, so I recommend taking profits.

Good luck in trading and see you tomorrow morning!

Analysis are provided by InstaForex

-

28-11-19, 06:15 #1151

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Forecast for EUR/USD on November 28, 2019

EUR/USD

On Wednesday, US statistics continued to delight investors and markets swayed towards the dollar. The euro lost 22 points. GDP for the third quarter amounted to 2.1% against the expectation of 1.9%, the volume of orders for durable goods increased by 0.6% in October against the forecast of -0.5%,

On the daily chart, the price went below the MACD indicator line. If today closes with a black candle, then the price will consolidate below it with the prospect of a medium-term decline. The immediate goal of this movement at 1.0925 is the lowest level of September 3 and 12. In the four-week period, the price of 1.0720/30 can be reached - the lower line of the blue price channel (visible on a very tight chart). The Marlin oscillator lies in the horizon in the negative trend zone, volatility is likely to be low in the thin market today.

On a four-hour chart, the price has consolidated under the blue line of MACD. The range between the levels of 1.0985-1.1026 is likely to be today (perhaps even tomorrow) a consolidation zone.

Analysis are provided by InstaForex

-

29-11-19, 07:37 #1152

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Why didn't the oil go upwards? Volume analysis for oil

Good evening, dear traders! Yesterday, we gave a trading idea for the growth of oil but paid attention to the evening news on oil reserves in the United States. Let's analyze this situation on volumes.

During the time of the opening of Europe, the price immediately went up and while it is on the way to the maximum of 58.74, there was another extremum - 58.56. At the breakdown of which, there was practically no doubt about the further increase in price. Looking at the chart, even the trend line up indicates purchases. However, It is very important that all this happened in the middle of the European session and before the release of the weekly news on Oil Reserves for about another 5 hours. That is, everyone only sees purchases.

At the time of the opening of the American session, there was also no increase in prices. Although the upward trend still remained, which added confidence in the growth.

In addition, at the time of the news release, summing up all mentioned above, the state of the price was such that all liquidity was not up, but, on the contrary, at the bottom with the nearest targets 58.13 and the American session of the previous day which is 57.76.

Oil's approach to the maximum in Europe:

Thus, the Europeans simply didn't have the courage to collect stocks before the reserves. Nevertheless, the stocks themselves came out large, which led to the sales of black gold.

This analysis is based on the US oil futures.

Analysis are provided by InstaForex

-

02-12-19, 09:05 #1153

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 40

- Posts

- 112

- Rep Power

- 0

Important intraday Level For EUR/USD, December 02,2019

When the European market opens, such economic data as Final Manufacturing PMI, German Final Manufacturing PMI, Italian Manufacturing PMI, French Final Manufacturing PMI, and Spanish Manufacturing PMI will be unveiled. The US will publish such eocnomic reports as ISM Manufacturing Prices, Construction Spending m/m, ISM Manufacturing PMI, and Final Manufacturing PMI.So, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1073.

Strong Resistance: 1.1067.

Original Resistance: 1.1056.

Inner Sell Area: 1.1045.

Target Inner Area: 1.1019.

Inner Buy Area: 1.0993.

Original Support: 1.0982.

Strong Support: 1.0971.

Breakout SELL Level: 1.0965.

(Disclaimer) *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

03-12-19, 06:45 #1154

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Control zones for USD/CAD on 12/03/19

During the second week, the pair is trading within the accumulation zone. This makes it possible to consider weekly extremes for finding entry points. The upper boundary is the maximum of the last week, which coincides with the Weekly Control Zone 1/2 1.3328-1.3319. Now, testing this zone will be decisive for the entire upward movement of the last month.

Working within the framework of the flat implies partial consolidation of transactions during tests of significant extremes.

An alternative model will be developed if the closure of today's trading occurs above the Weekly Control Zone 1/2. This will open the way for further growth. The nearest goal, in turn, will be the maximum of October. The test of which will increase the probability of a large offer.

Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year.

Analysis are provided by InstaForex

-

05-12-19, 06:25 #1155

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Forecast for USD/JPY on December 5, 2019

USD/JPY

The information received yesterday from the headquarters of the US and Chinese negotiators on trade encouraged the markets - representatives of the parties allowed the conclusion of the first phase of the deal until December 15, before the date of the introduction of tariffs on Chinese goods. The US S&P 500 index gained 0.63%, Nikkei 225 is currently up 0.70% and China A50 grew 0.36%. The price turned from the achieved first bearish goal - from the enclosed line of the price channel, a little short of the MACD line. The signal line of the Marlin oscillator is still in the negative trend zone, growth could continue, but still within the correction.

The correction can continue to the range of 109.30/50 (highs of October 30 and November 7), going over the range will mean the correction will go into a trend growth, the target will be the line of the green price channel in the region of 109.95. Leaving prices at yesterday's low opens the next bearish target at 107.57 - the intersection of the lines of the red and green price channels.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

-

06-12-19, 02:47 #1156

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Developing the trading idea for oil

Good evening, dear traders! I present to you the development of a trading idea for oil based on volumetric analysis!

Let me remind you that the idea for purchasing oil for the absorption of the decline last Friday was presented yesterday (12/04/19), which happened without the participation of America, because they had a public holiday. After that, the Americans traded for the next 2 trading sessions at prices that were not very profitable for sales, i.e. cheap relative to prices before the holidays.

The price increase occurred before the news on Oil Reserves, but this also increased the probability of a maximum update, since oil production was sharply reduced and today, there was an opportunity to add long positions in order to update the last maximum of 58.74.

As a result, 250 points were earned from the entry point 56.30 to the crossing 58.74. Moreover, it would bring +60 points when adding a long position or purchasing from oil reserves.

Forecast:

Developing trading idea with a description:

Good luck in trading and follow the money management!

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

-

09-12-19, 08:46 #1157

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 40

- Posts

- 112

- Rep Power

- 0

EUR/USD reacting below resistance, potential drop!

Trading RecommendationEntry: 1.10660Reason for Entry: 38.2% Fibonacci RetracementTake Profit : 1.10280

Reason for Take Profit: 61.8% Fibonacci retracementStop Loss: 1.11090Reason for Stop loss:

horizontal swing high resistance

(Disclaimer) *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

10-12-19, 04:54 #1158

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Plans for gold

Good day, dear traders! It is time to turn to gold, for which there is a possibility of a large medium-term decline. Last week turned out to be very exciting for this instrument: at first, the main driver was the news on China, on which gold showed strong growth, but the week ended with a sheer drop in non-farms and a complete absorption of "Chinese" growth. It is important to note that a false breakout of the level of 1478.68, an important level for November sellers, was shown last week which confirms their strength.

Therefore, I believe that in the medium term gold will decline at least to the level of 1445.33. Whether this breakout turns out to be real or false does not matter, its presence is what is of significance to us. It is also necessary to remember that there will be another Federal Reserve meeting and a decision on the interest rate on Wednesday evening, which gold will definitely react strongly to. Therefore, I believe that until Wednesday, the development of a trend for gold is unlikely. I recommend that you wait until the pullback at least half of the Friday fall, after which you can look for the opportunity to take short positions in the medium term in order to update the price mark of 1445.33.

If the Friday fall is completely absorbed by buyers, this will mean that the priority has changed and the bearish scenario can be considered unfulfilled.

I remind you that the day of increased volatility in gold is on Wednesday evening - the interest rate on USD, as well as the Fed conference.

I wish you success in trading and big profits!

Analysis are provided by InstaForex

-

13-12-19, 04:53 #1159

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Development of trading ideas for USD/CAD and oil.

Good evening traders! Congratulations to those who used our USD / CAD trading idea and oil last time.

Trading idea for USD / CAD:

Development of trading idea for USD / CAD:

Trading idea for oil:

Development of trading idea for oil:

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

-

17-12-19, 05:56 #1160

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Trading idea for GBP/USD pair

Good evening, dear traders! I present to your attention a trading idea for the GBP/USD pair.

So, the Conservatives won the parliamentary elections in the UK, and now, no one doubts that the party of Boris Johnson will bring Brexit to its logical conclusion. On this news, the GBP/USD pair increased by 3500p for 5zn namely at the time of the announcement of the preliminary results of the parliamentary elections. And all would be nothing - both positive and joy for Britain. Thus, only those who already knew does not speak about it. However, no one here says how it is possible to earn money on it now. Therefore, I suggest one simple trading idea based on the "Hunt for Feet" method, and it consists of developing the stops of pound buyers, from Friday, as well as today. The fact is that over the past 1.5 days, buyers can become (put their stops) only at the level of 1.33, which is also round. It is believed that this is a great goal of "stop hunters", and you can quite easily implement it by using the signals of your strategies on smaller time frames to enter.

As usual, it is recommended to develop against the "crowd." Following a strategy is a distinctive feature of successful trading.

Good luck in trading and follow the money management!

Analysis are provided by InstaForex

Similar Threads

-

Forex News from InstaForex

By InstaForex Gertrude in forum Advertisement PlaceReplies: 2103Last Post: 16-02-24, 10:27 -

Forex Technical & Market Analysis FXCC

By alayoua in forum Advertisement PlaceReplies: 4Last Post: 07-07-16, 00:25 -

Weekly technical analysis for 3 - 7.12, 2012

By bellalca in forum Affiliate program networksReplies: 0Last Post: 04-12-12, 07:09

Reply With Quote

Reply With Quote

Bookmarks