Thread: Instaforex Analysis

-

19-09-19, 08:20 #1121

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Forecast for AUD / USD pair on September 19, 2019

AUD / USD pair

The Australian dollar successfully broke the support area, consisting of two lines - balance and MACD of price channels and indicator lines. Moreover, the breakthrough occurred today on quite good employment data. The growth of new jobs amounted to 34.7 thousand against the expectation of 10.0 thousand and the share of the economically active population increased from 66.1% to 66.2%. Against this background, the level rose slightly to 5.3% from 5.2%, which is a fairly strong sign of the market's intention to sell the AUD/USD pair at an accelerated pace.

The Immediate target of 0.6678 at the support line for the red price channel coincides with the low of August 7 that can be reached in three days. Then, the blue channel comes into play with support in the region of 0.6605. On the four-hour chart, the price is in free fall and there are no signs of a stop in the correction.

Analysis are provided by InstaForex

-

20-09-19, 07:16 #1122

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Dramatic roles of the pound: a candidate for decline and a source of tension for the market

The UK currency is constantly under the scrutiny of market participants. The reason for this, analysts believe that it is the tense situation around Brexit, creating a danger for the pound itself as well as other currencies.

Many world currencies are involved in the orbit of the British pound. The currency of Great Britain in one way or another affects the means of payment of other countries, and currently this effect is negative. The pound's dynamics were significantly affected by weak macroeconomic statistics from the UK on inflation.

According to the report, the base consumer price index fell to 1.5% in August, which is the lowest level since November 2016. According to analysts, the current situation indicates the need to reduce interest rates in the UK. Weak macroeconomic statistics indicate that in the coming months the regulator may reduce interest rates. This is negative news for the British pound, analysts emphasize. It can noticeably lose in price.

Currently, the GBP/USD currency pair is trading in the consolidation range near the levels of 1.2453–1.2445. According to preliminary forecasts, in the event of a decrease in the current level, a further drop is possible to the level of 1.2400. With the implementation of a more optimistic scenario and the breakdown of the upper region of 1.2490, growth is likely to reach 1.2555. After that, the potential to decline to the 1.2400 level is growing, analysts summarize.

An alarming situation in European markets is provoked by uncertainty about Brexit. Currently, the European Parliament has approved, by a majority vote, a deferral for the UK if it so requests. However, this event has already been taken into account by the market, and the pound will not receive strong support from this news. In this situation, investors and traders will invest in more reliable assets, analysts are certain.

Analysis are provided by InstaForex

-

25-09-19, 09:04 #1123

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

Forecast for EUR/USD on September 25, 2019

EUR/USD

Yesterday was very unfortunate for two heads of state - Boris Johnson and Donald Trump; the Supreme Court of Great Britain declared the sending of Parliament on forced leave as unlawful and today it will return to work, and the House of Representatives of the US Congress began the impeachment procedure of Donald Trump for "betrayal of his oath of office, betrayal of our national security and betrayal of the integrity of our elections." The reason was allegedly his demand for the President of Ukraine Volodymyr Zelensky to launch an anti-corruption investigation against John Biden's son Hunter, the head of the gas company in Ukraine Burisma Group.

At the same time, the Ifo index of business sentiment in Germany rose from 94.3 to 94.6 in September, while the US consumer confidence index from the Conference Board dropped from 134.2 to 125.1 in the same month. The euro has grown by 26 points.

We do not believe that Trump is facing real impeachment, he just once again makes it clear that there is nothing for that "upstart" in the second presidential term. Earlier (at the end of April), we wrote that the Democratic Party successfully promoted its people to leading posts in many countries, now they need to restore "order" in the country.

From a technical point of view, the situation returned to normal over the day. On the daily chart, the signal line of the Marlin Oscillator is moving down from the boundary with the growth territory.

On a four-hour chart, the price turned around, not reaching the resistance of the indicator lines, Marlin returned to the decline zone. The main scenario with a decrease in the euro remains, the target of 1.0926 is a low of September 12 and 3.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

27-09-19, 07:52 #1124

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Forecast for EUR/USD on September 27, 2019

EUR/USD

On Thursday, amid a calm political background, the euro pushed through the signal support of 1.0926 and is now ready to work out the target range of 1.0805/45. The final estimate of US GDP for the 2nd quarter remained unchanged at 2.0%, which supported moderate optimism in the market. Today, orders for durable goods for August are expected to decrease by -1.1%, but personal income is projected to grow by 0.4%, as well as expenditures by 0.3%. Taking into account yesterday's data on incomplete sales in the secondary market at 1.6% against the forecast of 1.0%, as well as rising indicators for real estate prices and growth in consumer confidence released this week, data on expenses and income may even exceed expectations. which can become the main news of the day.

Technically, on the daily chart, the situation is completely falling - chart indicators and the oscillator in a downward position.

On the four-hour chart, there is also a downward trend; price below the lines of balance and MACD, the signal line of the Marlin oscillator forms a kind of triangle, which may be a sign of a continuation of the downward trend.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

-

30-09-19, 08:51 #1125

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

Forecast for EUR/USD on September 30, 2019

EUR/USD

On Friday, after the euro's attempt to overcome support at 1.0926, the price chose to return a little higher in order to try to do it with fresh energy in the new week. This morning a little strength was given by economic data on the Asia-Pacific; retail sales for August show growth of 2.0% y/y against the forecast of 0.7% y/y, business activity in the manufacturing sector of China (Manufacturing PMI) for September increased from 49.5 to 49.8. In the afternoon, employment indicators in the euro area will come out, forecasts are neutral, so investors are interested in how much the data deviate from expectations.

On a four-hour chart, the price is near the signal level of 1.0926, consolidating below it will launch the main decline scenario. We are waiting for the price in the target range of 1.0806/44, formed by the line of the price channel and the Fibonacci level of 161.8%. Strong economic indicators in the euro area and weak in the US (if the Chicago PMI is weaker than the forecast of 50.0) may pull up the euro to the MACD line, to around 1.1000.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

01-10-19, 08:44 #1126

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

Forecast for EUR/USD on October 1,2019

EUR/USD

The euro fell by 38 points on Monday. The readings of technical indicators have become even more bearish. On the daily chart, the Marlin oscillator penetrates deeper into the negative trend zone. The target range is the gap from the price channel line to the Fibonacci level of 161.8% - 1.0806/44. Consolidating the price below it opens the second target at 1.0710 - the low of January 2016.

On a four-hour chart, the signal line simultaneously develops in two conflicting patterns; a convergence reversal formation is formed, but within the framework of a simple rectangle. In this case, both signals lose power. In the evening, ISM Manufacturing PMI will be released in the September assessment - the forecast is 50.4 versus 49.1 in August, and an increase can also be shown for construction costs in August - the forecast is 0.5% against 0.1% earlier. We look forward to further weakening of the eur

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

02-10-19, 10:04 #1127

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Technical analysis of ETH/USD for 02/10/2019

Crypto Industry News:

Testnet network Ethereum under the name Istanbul (which operates under the Ropsten testnet) was launched on September 30. Considering the existing problems related to the dates of the planned hard forks, this can be considered a great success. The whole was able to run even two days before the earlier announced date, which fell on October 2.

Unfortunately, after the activation of Ropsten an unplanned fork occurred. So now two chains are working.

The issue of the community centered around the Vitalik Buterin platform was explained by the community manager at the Ethereum Hudson Jameson Foundation. In his tweet from yesterday, he described what happened. Today, some miners are still mining the old version of Ropsten. Another copy of its new, updated version. The programmer, however, calms down. The problem is to be solved. Information should not worry investors: they are testnets, so that such errors come out during their duration.

Jameson also explains what exactly happened. The genesis of the problem is the nature of blockchains based on the proof-of-work algorithm, including Ethereum. The miners in them must independently update the software to be able to dig as part of a new chain. This time some of them did not and the result was an unplanned division.

Technical Market Overview:

The ETH/USD pair has made a new local high at the level of $185.05, but so far couldn't make it to the 50% of Fibonacci retracement located at the level of $187.37. The supply zone located between the levels of $172.82 - $176.66 has been clearly broken, the momentum is now increasing significantly, so there is a chance for the bulls to hit the level of 50% of even the 61% shortly if the trendline dynamic support around the level of $172.82 will provide the bounce. In the case of a trendline violation, the nearest technical support is located at the level of $163.98.

Weekly Pivot Points:

WR3 - $256.80

WR2 - $233.68

WR1 - $197.61

Weekly Pivot - $174.45

WS1 - $137.03

WS2 - $112.52

WS3 - $77.73

Trading Recommendations:

The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another impulsive wave up of a higher degree and uptrend continuation

Analysis are provided by InstaForex

-

03-10-19, 06:51 #1128

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Trading Idea for NZD/CAD

As you know, cross-rates are an excellent tool for hedging positions in "majors", such as the most popular of them - the EUR/USD pair.

I recommend for each position in major - to have a position in the "right" cross, and you will appreciate this tactic of distributing profits between instruments.

Let's pay attention to the very oversold NZD/CAD cross-instrument, which has passed 10,000 p for 5 figures almost without a pullback since March 2019. However, several people know that this cross has an average rollback passage of exactly 10 points. And right now, after updating the minimum of 2015, it makes sense to buy it with a potential of at least 3,000 p at 5 figures.

It is easier to do this by collecting a grid of orders in longs on pullback movements. In fact, you will work out a false breakdown on an annual scale, or rather - for 4 years. This does not happen every day. Therefore, it is necessary to take advantage of this unique opportunity.

Analysis are provided by InstaForex

-

04-10-19, 09:07 #1129

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Elliott wave analysis of GBP/JPY for October 4 - 2019

GBP/JPY is now hovering just above the ideal corrective target at 130.78. We continue to look for a final dip closer to this target as long as minor resistance at 132.55 and more importantly as long as resistance at 133.36 is able to cap the upside. However, a break above resistance at 133.36 will indicate that red wave ii has completed and red wave iii towards 139.15 is developing.

R3: 133.36

R2: 132.85

R1: 132.55

Pivot: 132.00

S1: 131.47

S2: 131.25

S3: 130.78

Trading recommendation:

We will buy GBP at 131.25 or upon a break above 132.55

Analysis are provided by InstaForex

-

07-10-19, 06:15 #1130

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Control zones GBP/USD 10/07/19

The pair is trading between two significant zones. The resistance was Weekly Control Zone 1/2 1.2388-1.2372, and the weekly CZ 1.2246-1.2213 became the support. To continue medium-term growth, closing of trading above the level of 1.2388 on Monday will be required. This will pave the way for the September maximum. This model has a 50% chance of working out.

The continuation of the medium-term growth may become the main model for the coming week, as many pairs associated with the dollar formed a reversal pattern in the direction of strengthening.

An alternative model will be developed if the Weekly Control Zone 1/2 test leads to an increase in supply and a halt to growth. This will indicate the formation of a local accumulation zone, where the main goals will be the extremes of last week.

Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zonethat reflects the average volatility over the past year.

News are provided by InstaForex

-

08-10-19, 06:02 #1131

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Fractal analysis of Bitcoin on October 8

Forecast for October 8:

Analytical review of cryptocurrency on a scale of H1:

For the Bitcoin instrument, the key levels on the H1 scale are: 9026.00, 8811.75, 8666.36, 8379.42, 8287.60, 8039.21, 7893.53 and 7698.41. Attention! This instrument is characterized by medium-term trend trading. Here, as expected, the price formed a local structure for the top of October 7. In addition, this instrument has a good correlation with the euro / yen.

The range for entering the market for the purchase is 7948.00 - 8380.00. We expect the development of the upward cycle after the price passes the noise range 8287.60 - 8379.42. In this case, the first goal is 8666.36. Meanwhile, price consolidation is in the range of 8666.36 - 8811.75, as well as a possible rollback to correction. The potential value for the top, where it makes sense to close the position - 9026.00. The range 8039.21 - 7893.53 is a key support for the ascending structure. Its passage at the price will lead to the cancellation of this structure. In this case, the first goal is 7698.41. However, to trade in a downward direction, it makes sense when the local initial conditions for a downward cycle are formed.

The main trend is the initial conditions for the top of October 7.

Trading recommendations:

Buy: 7948.00 - 8380.00 Stop Loss: 7891.00 Take profit: 8666.36

To continue :

Stop Loss: 8287.60 Take profit: 9026.00

Analysis are provided by InstaForex

-

09-10-19, 07:38 #1132

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Forecast for AUD/USD on October 9, 2019

AUD/USD

the opening of the week, the Australian dollar has developed on the scale of a four-hour chart. All days, until this morning, the price was reflected from the support of the MACD line of a four-hour scale. The signal line of the Marlin oscillator penetrates into the growth zone.

Now the aussie is ready to close the gap formed at the beginning of the week. The purpose of growth is the line of the price channel of the daily scale near the MACD line at around 0.6790. We the fall to resume from the target level.

Analysis are provided by InstaForex

-

11-10-19, 07:29 #1133

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

GBP/USD continues to grow, despite weak data from the UK

The continued sale of the dollar helped maintain the positive dynamics of the pound, but otherwise the prospects for the British currency are not very good. The UK economy fell by 0.1% in August against the expected stable value. Indicators of manufacturing and industrial production also fell short of forecasts. While the GBP/USD pair maintains its upward trend, although it has slightly deviated from recent highs in response to weak economic data. Demonstrating the miracles of resilience in the 1.2200 mark for the third consecutive session, the pair was able to restore positive movement, however, only amid continued active sales of the dollar.

In principle, weaker than expected macroeconomic data in the UK could not have a significant impact. Nevertheless, the positive impulse did not receive a new charge, while the pair confidently holds the blow and tries to gain a foothold at a new height, despite the fact that the UK monthly GDP report showed that the economy unexpectedly declined by 0.1% in August. In addition to this, UK manufacturing and manufacturing declined more than expected in August, although this drop was partially offset by a lower-than-expected trade deficit. Now it will be interesting to see if the pair can benefit from the positive movement or fail again at higher levels amid continuing uncertainty surrounding Britain's exit from the European Union.

Analysis are provided by InstaForex

-

14-10-19, 05:33 #1134

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

EUR/USD and GBP/USD. Preview of the new week. The EU summit, Brexit, inflation in the European Union

It is safe to say that we can call the new week, the"Week of Great Britain." Most of the macroeconomic reports planned for the week will concern the GBP/USD pair. Most of the reports regarding the GBP/USD pair will come from the UK. In addition to economic data, it will be decided whether a new Brexit date will be postponed, whether Boris Johnson and the European government will be able to agree on a "deal" and whether the British Parliament will block a new deal if, by some miracle, Brussels and London succeed to reach consensus on all contentious issues in five days? Thus, the EUR/USD pair may feel relatively calm, just as it did the previous week, but the British pound is likely to break volatility records and very often change its direction if the news comes mixed. But consider all the data in more detail.

As for the EUR/USD pair, here from macroeconomic events we can note the report on the change in industrial production in August on Monday, the inflation report for September on Wednesday. The greatest interest, of course, will be caused by the consumer price index, which in recent months has fallen to absolute lows. A value below 1.0% will no longer be considered just low, but critical. And then it can be expected from the ECB and a new reduction in key rates, the quantitative stimulus program in the first months of its operation is unlikely to be changed, but in the future it can be expanded. And for the euro, these are all potential bearish factors. We still believe that in the confrontation with the dollar, a single European trump card is very small. And at the moment, we consider the main factor behind the growth of the euro a banal technical need to be adjusted from time to time. There is no positive news from the EU. Recently, everything is not good in the United States too, but America's economy is still stronger, macroeconomic indicators are higher, monetary policy is tougher. It is these factors that continue to play for the dollar.

Analysis are provided byInstaForex.

-

15-10-19, 07:39 #1135

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

USD/CAD - Heading downwards

Greetings, dear traders. This time, I will show you a long-term recommendation on an instrument such as USD / CAD.

What is interesting in this instrument now? First of all, the data on unemployment from Canada came out last Friday. Typically, these reports come out simultaneously with American Non-farm (NFP), but this time, the publication was separate. With this impulse, the Canadian dollar strengthened strongly against the US dollar, completely absorbing the abnormal growth a week earlier. At the moment, this indicates a very strong seller in the market.

Since the plan is long-term, its implementation can take from several days to several weeks. Thus, it makes sense to wait for a rollback and consider selling on smaller TFs.

It's important to understand that a lot of data will be released on Wednesday, such as the base index of retail sales for the American dollar and inflation for the Canadian one. Moreover, regular oil reserves will also affect the Canadian dollar. What is more reasonable here would be to expect the continuation of decline precisely after the release of all these news on Wednesday.

I wish you success in trading and big profits!

Analysis are provided by InstaForex

-

16-10-19, 05:52 #1136

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

EUR/USD - through thorns to the stars!

Greetings, dear traders. It is time to remember about EUR/USD, which has successfully fulfilled our previous plans. Following GBP/USD, the European currency is now demonstrating a strong bullish direction. It's easy to guess that all these movements are connected with the next portion of news regarding Brexit. If you omit all the fundamental details and focus on how to make money from it, the answer is simple. To take a neat positions in the purchases with a pullback. At the same time, wherever you try to buy, the extreme point of the scenario cancellation is today's minimum at the quote of 1.0991. Therefore, you can limit losses to this level. It is recommended to holding purchases (at least partially) at the level of 1.1064, since this is an important level for sellers over the past few days.

I wish you success in trading and big profits!

Analysis are provided by InstaForex

-

18-10-19, 04:14 #1137

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

GBP/USD. Turns of the British currency: Johnson repeats the path of Theresa May

Passion for Brexit reaches its zenith. In the afternoon, the pound paired with the dollar soared to the borders of the 30th figure (that is, to 5-month highs), responding to a statement by European Commission President Juncker that the deal between London and Brussels is "ready." But literally an hour later, the pair collapsed 200 points down after the first comments by representatives of the British Parliament. The opposition did not skimp on epithets: in particular, Jeremy Corbyn called the draft deal "corrupt", adding that Johnson's dealings were "even worse than Theresa May". However, despite such harsh comments, the market still expects the British prime minister to submit the draft deal to the House of Commons on Saturday.

At that time, Michel Barnier, the chief negotiator from the European Union, was the main newsmaker. Exactly a year ago, he said that the deal could already be concluded during the EU summit, which, like this year, was held on October 17-18. Brussels and London then were able to find a common denominator in many key issues, moreover, within the framework of Theresa May's Chequers plan, which the future Prime Minister Boris Johnson so eagerly criticized. May proposed to solve the Irish question in a different way: she agreed to establish checkpoints on the border and introduce "certain administrative procedures". EU representatives refused to consider other options, and interpreted the proposed conditions as a compromise. As you know, the deputies of the House of Commons categorically rejected the proposed conditions, failing the vote three times.

Thus, Johnson will have a difficult battle in the walls of Parliament. Judging by the dynamics of the pound, traders do not lose hope of agreeing on a deal this Saturday: otherwise, the GBP/USD pair will return first to the middle of the 24th figure, and then (less impulsive) to the levels of annual lows, that is, to the bottom of the 20th figure. If a "miracle" happens and the prime minister finds votes in Parliament, the pound paired with the dollar will fly up to 1.35-1.37, up to the 40th figure, after the deal between London and Brussels is officially agreed. And although these price values look abnormally high, it is worth recalling that on the eve of the 2016 referendum, the GBP/USD pair was trading in the area of 1.43-1.46, and after the announcement of the results, the plebiscite plunged to 1.25-1.27 in a few weeks, followed by a decline to the bottom of 20- x figures. "The return trip to an upward direction" may not be so impulsive, but at the same time, the resolution of many years of intrigue will allow the pair to grow by at least 500-600 points. As the saying goes, The Show Must Go On ...

Analysis are provided by InstaForex

-

21-10-19, 08:24 #1138

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

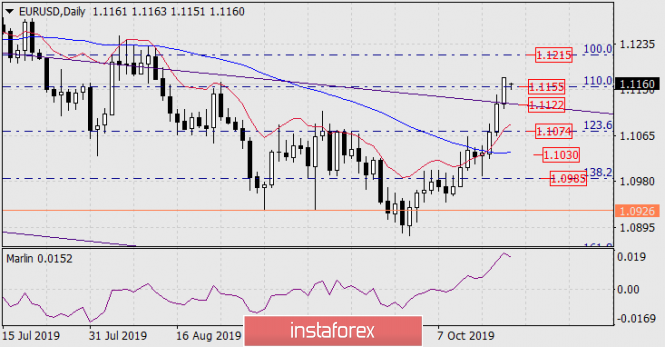

Forecast for EUR/USD on October 21, 2019

The euro exceeded the closest target level of 1.1155 at the Fibonacci level of 110.0% on Friday, probably on the optimism of investors on a new EU deal with the British prime minister about more favorable conditions for themselves than they were before (Theresa May's options). Today, the British Parliament begins to finalize the deal.

On the daily chart, the price has consolidated above the line of the descending price channel, the Marlin oscillator shows a reversal only to insignificant depth, therefore the next target of 1.1215 as the Fibonacci level of 100.0% becomes relevant.

On the four-hour chart, Marlin is expanding deeper, but it has not yet formed a divergence as a reversal formation, which also speaks in favor of the rising scenario. A trend reversal, of course, does not have to be accompanied by divergences, but then the fall of the signal line should be sharp, with the formation of a spike. So, we are waiting for the euro to grow by around 70 points, after which reversal elements may be added to the technical picture.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

24-10-19, 04:33 #1139

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

USD / CAD: Sellers in business

Good evening, dear traders. Today, there is a small recommendation on USD / CAD, and the decline of which is now very likely.

The thing is that yesterday's news from Canada caused a great reaction from the market, and in the end, we see that all the news impulses from the buyer were completely absorbed, and this is a harbinger of even a local, but decline.

Therefore, today, I recommend trying to work on the decline of USD / CAD currency pair with a take profit at around 1.3070. Moreover, the maximum point of yesterday's loss will be considered to be the maximum of yesterday's news - the level of 1.3121. If the price updates the maximum, the scenario can be considered completely canceled.

I wish you success in trading and huge profits!

Analysis are provided by InstaForex

-

04-11-19, 07:51 #1140

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Control zones EURUSD 11/04/19

At the end of last week, the defining resistance was the Weekly Control Zone 1/2 1.1161-1.1153. At the same time, the closing of trading on Friday occurred above this zone. This opens up opportunities for further growth of the pair to weekly control zone 1.1249-1.1233. The euro purchases come to the fore, however, favorable prices are located just below the level of 1.1134.

At the moment, the pair is trading near the maximum of the last month, which increases the possibility of the proposal and the continuation of the formation of the accumulation zone. Work within the accumulation zone will be relevant until the closure of one of the active sessions occurs above the weekly maximum. If this happens, then the growth rate will increase and a weekly test will take one to two days. In the event of a major offer after updating the monthly maximum, the target will be the level of 1.1134, where a new priority will be determined.

Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year.

Analysis are provided by InstaForex

Similar Threads

-

Forex News from InstaForex

By InstaForex Gertrude in forum Advertisement PlaceReplies: 2103Last Post: 16-02-24, 10:27 -

Forex Technical & Market Analysis FXCC

By alayoua in forum Advertisement PlaceReplies: 4Last Post: 07-07-16, 00:25 -

Weekly technical analysis for 3 - 7.12, 2012

By bellalca in forum Affiliate program networksReplies: 0Last Post: 04-12-12, 07:09

Reply With Quote

Reply With Quote

Bookmarks