Thread: Instaforex Analysis

Hybrid View

-

02-03-18, 08:00 #1

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Elliott wave analysis of EUR/NZD for March 2, 2018

Wave summary:

There is not really anything new to say here. We continue to look for a continuation higher through the resistance at 1.6960 and 1.6999 for a continuation towards 1.7094 and 1.7470 as the next upside targets.

Short-term support is seen at 1.6867 and again at 1.6809.

R3: 1.7094

R2: 1.6999

R1: 1.6960

Pivot: 1.6900

S1: 1.6867

S2: 1.6809

S3: 1.6778

Trading recommendation: We are long EUR from 1.6790 with stop placed at break-even.

Analysis are provided by InstaForex

-

07-03-18, 07:01 #2

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

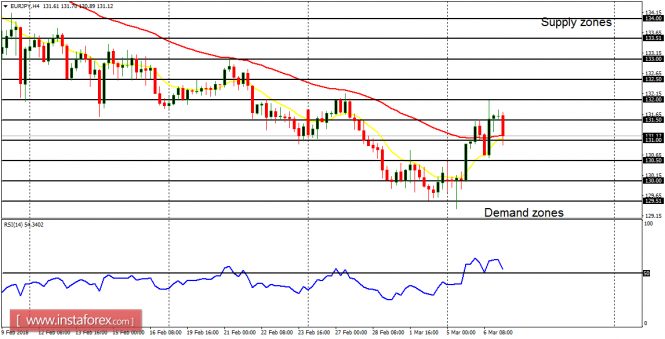

Daily analysis of EUR/JPY for March 7, 2018

EUR/JPY

There is recently an upwards bounce in the market – in the context of a downtrend. The upwards bounce is yet to nullify the downtrend, but it would do so as soon as the price goes above the supply zone at 132.50, which would require a strong buying pressure. Right now, the EMA 11 is almost crossing the EMA 56 to the upside, and the RSI period 14 is above the level 50. Once the EMA 11 is above the EMA 56, the bias on the market would turn bullish.

There is still a Bearish Confirmation Pattern in the market, but the recent rally has become a threat to the extant bearish outlook. Nonetheless, a strong rally is in the offing, as the outlook on EUR pairs remains bullish for this week.

Analysis are provided byInstaForex.

-

09-03-18, 08:40 #3

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Technical analysis of EUR/USD for March 09, 2018

When the European market opens, some economic data will be released such as the French Industrial Production m/m, the French Gov Budget Balance, the German Trade Balance, and the German Industrial Production m/m. Meanwhile, the US will also deliver some reports such as the Final Wholesale Inventories m/m, the Unemployment Rate, the Non-Farm Employment Change, and the Average Hourly Earnings m/m. So amid the reports, EUR/USD will move in a medium to high volatility during this day.

TODAY'S TECHNICAL LEVELS:

Breakout BUY Level: 1.2369.

Strong Resistance:1.2362.

Original Resistance: 1.2350.

Inner Sell Area: 1.2338.

Target Inner Area: 1.2309.

Inner Buy Area: 1.2280.

Original Support: 1.2268.

Strong Support: 1.2256.

Breakout SELL Level: 1.2249.

Analysis are provided byInstaForex.

-

12-03-18, 07:49 #4

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

USD/JPY has reached our profit target perfectly, prepare for further rise

The price has risen perfectly to our profit target and looks poised to rise further after breaking a strong descending resistance-turned-support line. We look to buy above 106.48 (Fibonacci retracement, horizontal overlap support, breakout level) for a push up to 108.51 (Fibonacci retracement, horizontal pullback resistance). We do have to be cautious about 107.78 resistance as the price might react off that level.

RSI (89) has made a similar bullish exit signaling a change in momentum from bearish to bullish.

Buy above 106.48. Stop loss at 105.81. Take profit at 108.51

Analysis are provided byInstaForex.

-

20-03-18, 12:25 #5

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

NZD/USD Intraday technical levels and trading recommendations for for March 20, 2018

Daily Outlook

In July 2017, an atypical Head and Shoulders pattern was expressed on the depicted chart which indicated upcoming bearish reversal.

As expected, the price level of 0.7050 failed to offer enough bullish support for the NZD/USD pair. That's why, further bearish decline was expected towards 0.6800 (Reversal pattern bearish target).

Evident signs of bullish recovery was expressed around the depicted low (0.6780). An inverted Head and Shoulders pattern was expressed around these price levels.

The price zone of 0.7140-0.7250 (prominent Supply-Zone) failed to pause the ongoing bullish momentum. Instead, a bullish breakout above 0.7250 was expressed on January 11.

That's why, a quick bullish movement was expected towards the depicted supply zone (0.7320-0.7390) where evident bearish rejection and a valid SELL entry were expected.

On February 2, a bearish engulfing daily candlestick was expressed off the price level of 0.7390. Moreover, a double-top reversal pattern was expressed around the price zone (0.7320-0.7390).

The price zone (0.7320-0.7390) stood as a significant supply zone for the NZD/USD pair. Any bullish pullback towards this price zone should be considered for a valid SELL entry.

On the other hand, bearish breakdown of 0.7300 (neckline) is needed to confirm the depicted reversal pattern. Bearish projection target would be located around 0.7050 and 0.7000.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

21-03-18, 12:08 #6

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

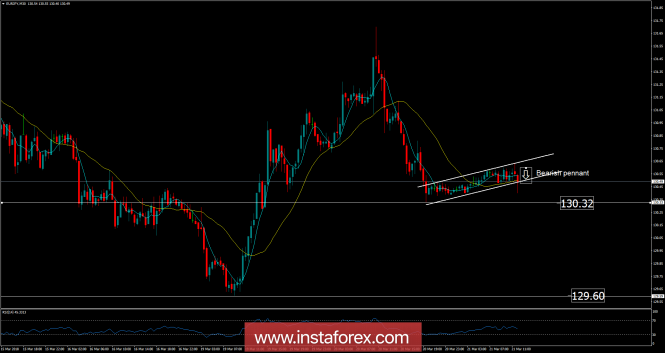

EUR/JPY analysis for March 21, 2018

Recently, the EUR/JPY pair has been trading sideways at the price of 130.48. According to the 30M time frame, I found that price has broken the upward channel (bearish pennant) in the background, which is a sign that buying looks risky. I also found a strong downward leg in the background, which is another sign of weakness. My advice is to watch for potential selling opportunities. Downward targets are set at the price of 130.32 and at the price of 129.60.

Resistance levels:

R1: 131.30

R2: 132.20

R3: 132.65

Support levels:

S1: 129.93

S2: 129.44

S3: 128.53

Trading recommendations for today: watch for potential selling opportunities.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

23-03-18, 07:08 #7

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

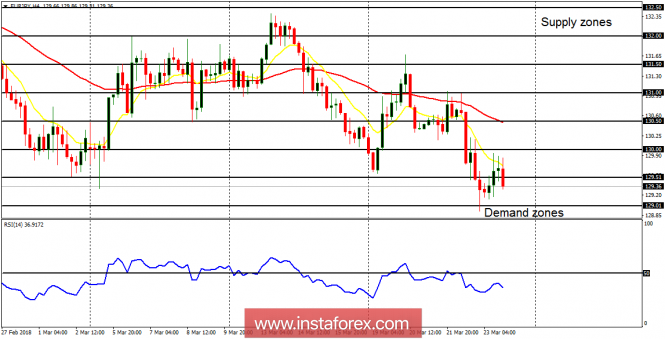

Daily analysis of EUR/JPY for March 23, 2018

EUR/JPY

The long-awaited bearish bias has already surfaced on this cross. The price plunged yesterday, breaching the supply zone at 129.50 to the downside. The demand zone at 129.00 was tested before the price bounced upwards (temporarily). The demand zone at 129.00 would be tested once again, and get broken to the downside, as the market moves further downwards.

There is a Bearish Confirmation Pattern in the market, and it has become clearer as price goes further downwards owing to a bearish outlook on the cross. The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50.

Analysis are provided byInstaForex.

-

26-03-18, 09:09 #8

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Daily analysis of EUR/JPY for March 26, 2018

EUR/JPY

The conditions in the market is quite choppy. Although the market is choppy, the bearish trend has been maintained.Price has been going southward since February 5, having lost almost 800 pips since then. Last week, there was a rally attempt in the context of an uptrend, which was halted once the supply zone at 131.50 had been tested.

Further upward movement was effectively prevented. The market shed 250 pips following that, to test the demand zone at 129.00, and closed below the supply zone at 129.50. The expected weakness in EUR, as well as the bearish outlook on the market, may enable the demand zones at 129.00, 128.50, and 128.00 to be tested this week.

Analysis are provided byInstaForex.

-

27-03-18, 08:07 #9

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Daily analysis of GBP/USD for March 27, 2018

The pair stays strong in the short-term as the price action is consolidating above the support zone of 1.4136. Currently, GBP/USD is facing off the resistance level of 1.4225, which is the last hurdle ahead of the 1.4269 level and if it manages to break above such area, the bulls could strengthen in the short-term. MACD indicator remains in the positive territory, favoring to the bulls.

H1 chart's resistance levels: 1.4225 / 1.4269

H1 chart's support levels: 1.4136 / 1.4061

Trading recommendations for today: Based on the H1 chart, buy (long) orders only if the GBP/USD pair breaks a bullish candlestick; the resistance level is at 1.4225, take profit is at 1.4269 and stop loss is at 1.4185.

Analysis are provided byInstaForex.

-

28-03-18, 08:36 #10

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

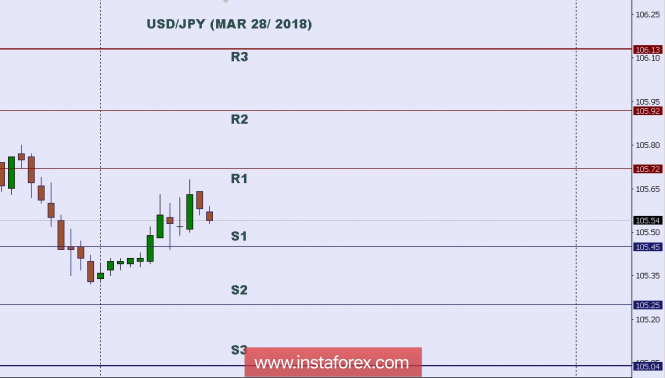

Technical analysis: Intraday level for USD/JPY, March 28, 2018

Today Japan will not release any Economic Data, but the US will release some Economic Data such as Crude Oil Inventories, Pending Home Sales m/m, Prelim Wholesale Inventories m/m, Goods Trade Balance, Final GDP Price Index q/q, and Final GDP q/q. So, there is a probability the USD/JPY will move with a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 106.13.

Resistance. 2: 105.92.

Resistance. 1: 105.72.

Support. 1: 105.45.

Support. 2: 105.25.

Support. 3: 105.04.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

02-04-18, 08:56 #11

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Technical analysis: Intraday Level For EUR/USD, April 02, 2018

When the European market opens, the US will release the Economic Data such as ISM Manufacturing Prices, Construction Spending m/m, ISM Manufacturing PMI, and Final Manufacturing PMI, so amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2372.

Strong Resistance:1.2365.

Original Resistance: 1.2353.

Inner Sell Area: 1.2341.

Target Inner Area: 1.2312.

Inner Buy Area: 1.2283.

Original Support: 1.2271.

Strong Support: 1.2259.

Breakout SELL Level: 1.2252.

Analysis are provided byInstaForex.

-

06-04-18, 09:53 #12

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

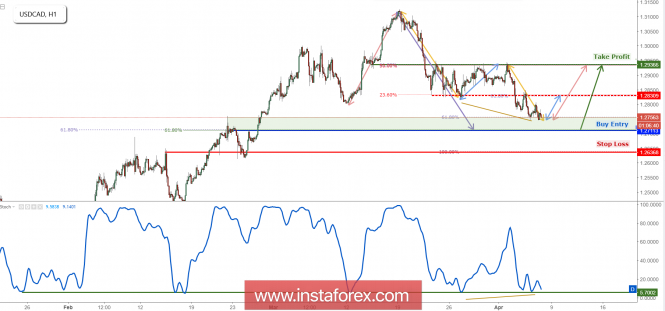

USD/CAD Approaching Support, Prepare For A Bounce.

USD/CAD is approaching its support at 1.2711 (61.8% Fibonacci extension, 61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap support) where we expect a bounce, pushing price all the way up to its resistance at 1.2936 (61.8% Fibonacci extension, 50% Fibonacci retracement, horizontal overlap resistance). We do however have to take note of the intermediate resistance at 1.2830 (61.8% Fibonacci extension, 23.6% Fibonacci retracement, horizontal overlap resistance).

Stochastic (89, 5, 3) is approaching its support at 5.7% where we expect to see a bounce. A bullish divergence in the price has also been identified which contributes to our bullish bias.

Buy above 1.2711. Stop loss at 1.2636. Take profit at 1.2936.

-

24-04-18, 08:54 #13

Veteran Member

Just starting here

Veteran Member

Just starting here

- Join Date

- Jun 2013

- Age

- 40

- Posts

- 4,044

- Rep Power

- 0

Daily analysis of USDX for April 24, 2018

USDX is posting fresh multi-day highs above the 200 SMA at H1 chart and the resistance zone of 91.75 could be challenged in coming days, as we're watching a possible breakout of the 90.63 level, which has been proven to be a tough resistance to crack. However, a retracement at the current stage should be limited by the moving average mentioned above.

H1 chart's resistance levels: 90.63 / 91.75

H1 chart's support levels: 89.36 / 87.88

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bearish candlestick; the support level is at 90.63, take profit is at 91.75 and stop loss is at 89.49.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex

-

04-05-18, 12:39 #14

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

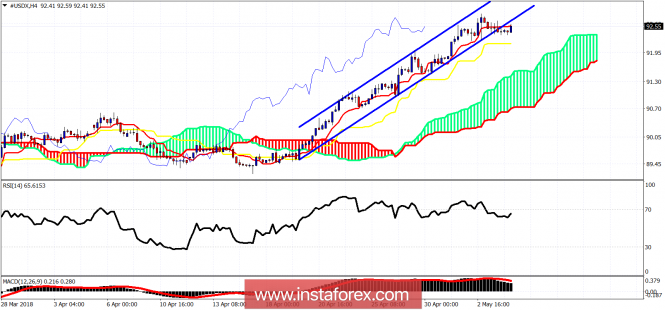

Technical analysis on USDX for May 4, 2018

The Dollar index has broken out of the bullish channel. Price has been giving bearish divergence signs in the RSI for the last few days while it was making higher highs and higher lows. With Non Farm Payrolls expected today, traders should be very cautious and wait to act until after the announcement.

Blue lines - bullish channel

The Dollar index above the Ichimoku cloud. Trend remains bullish. However we have two warning signs. The break below the channel and the bearish divergence in the RSI. Short-term support is at 92.15 and next at 91.40. I expect a major trend reversal to occur today or early next week to the downside. I would not be buying the index around current levels but look for selling.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

01-06-18, 09:41 #15

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

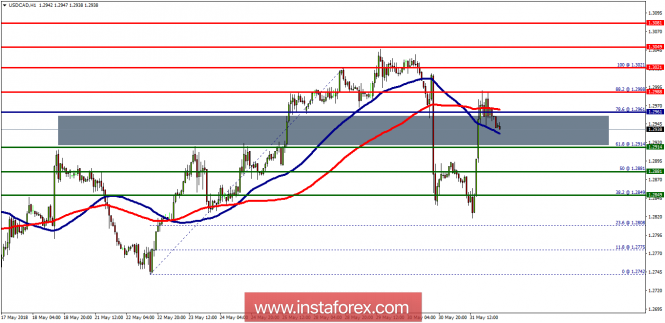

Technical analysis of USD/CAD for June 01, 2018

Overview:

Pivot: 1.2961.

The USD/CAD pair will continue to rise from the level of 1.2914. The support is found at the level of 1.2914, which represents the 61.8% Fibonacci retracement level on the H1 chart. The price is likely to form a double bottom. Today, the major support is seen at 1.2914, while immediate resistance is seen at 1.3021. Accordingly, the USD/CAD pair is showing signs of strength following a breakout of the high at 1.2914. So, buy above the level of 1.2914 with the first target at 1.3021 in order to test the daily resistance 1 and move further to 1.3049. Also, the level of 1.3049 is a good place to take profit because it will form a new double top. Amid the previous events, the pair is still in an uptrend; for that we expect the USD/CAD pair to climb from 1.2914 to 1.3049 today. At the same time, in case a reversal takes place and the USD/CAD pair breaks through the support level of 1.2914, a further decline to 1.2849 can occur, which would indicate a bearish market.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

04-06-18, 10:59 #16

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

Technical analysis of Bitcoin for June 04, 2018

If we look at the 4-hour chart, we see that Bitcoin has hit the dynamic support Exponential 100-period Moving Average by Close (near a downward sloping channel). It seems that BTC is going down to test the lower channel and this has been already confirmed too by divergence between the Stochastic Oscillator and the price. A long as this Cryptocurrency does not break out and closes above the 7,754.45 level, the bias of the Bitcoin price is still bearish.

(Disclaimer)

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

14-06-18, 09:49 #17

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

AUD/USD Approaching Support, Prepare For A Bounce!

AUD/USD is approaching its support at 0.7560 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, horizontal swing low support) where we expect to see a bounce, causing the price to rise to its resistance at 0.7659 (61.8% & 50% Fibonacci retracement, horizontal overlap resistance).

Stochastic (89, 5, 3) is approaching its support at 9.6% where a corresponding bounce is expected.

Buy above 0.7560. Stop loss 0.7513. Take profit at 0.7659.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

27-06-18, 11:26 #18

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

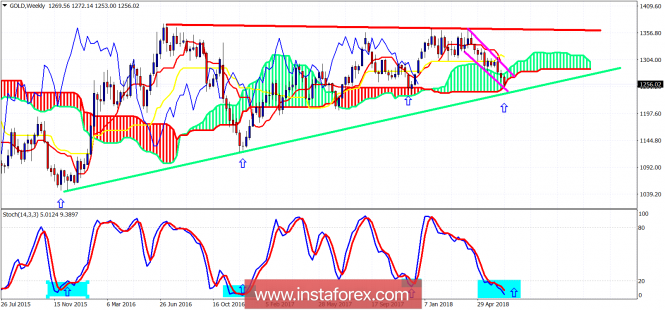

Technical analysis on Gold for June 27, 2018

Gold price remains in a bearish trend. Price is approaching important weekly support levels and at least a short-term bounce is approaching. Gold price has weekly oversold signals, warning not to be bearish at current levels. We have no reversal confirmation yet, but we believe that soon we will see the reversal. The key level is at $1,268.

Green line - long-term support

Red line - long-term resistance

Blue arrows - reversal points when Stochastic was oversold.

Gold price is challenging the weekly cloud support and the weekly upward sloping trend line. All the previous times the stochastic was so oversold, Gold rallied. Our time frame is for the next 1-2 months and therefore our risk tolerance should be similar to the downside. Our target remains new highs above $1,400.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

28-06-18, 10:39 #19

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

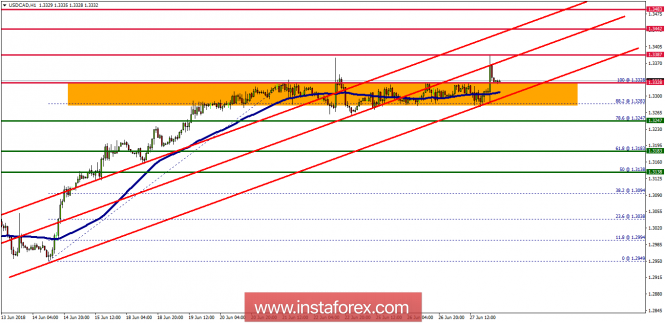

Technical analysis of USD/CAD for June 28, 2018

Overview:

The USD/CAD pair broke the resistance that turned into strong support at the level of 1.3247 since days. The level of 1.3247 coincides with the ratio of 78.6% Fibonacci which is expected to act as a major support on the H1 chart today. Consequently, the first support is set at the level of 1.3247. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 1.3247/1.3300. So, the market is likely to show signs of a bullish trend around 1.3247 - 1.3300. In other words, buy orders are recommended above the ratio of 78.6% Fibonacci (1.3247) with the first target at the level of 1.3387 in order to test the first resistance in the same time frame. If the pair succeeds to pass through the level of 1.3387, the market will probably continue towards the next objective at 1.3442. The daily strong support is seen at 1.3247. Thus, if a breakout happens at the support level of 1.3243, then this scenario may be invalidated.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

29-06-18, 10:14 #20

Senior Member

Just starting here

Senior Member

Just starting here

- Join Date

- Jul 2013

- Age

- 41

- Posts

- 112

- Rep Power

- 0

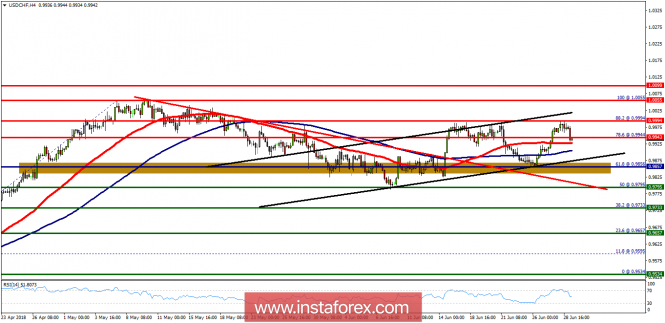

Technical analysis of USD/CHF for June 29, 2018

The USD/CHF pair faced resistance at the level of 0.9943. The strong resistance has been already formed at the level of 0.9943 and the pair is likely to try to approach it in order to test it again. However, if the pair fails to pass through the level of 0.9943, the market will indicate a bearish opportunity below the new strong resistance level of 0.9943 (the level of 0.9943 coincides with a ratio of 78.6% Fibonacci). Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50). Thus, the market is indicating a bearish opportunity below 0.9943, so it would be good to sell at 0.9940 with the first target of 0.9795. It will also call for a downtrend in order to continue towards 0.9733. The daily strong support is seen at 0.9733. On the other hand, the stop loss order should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.0055 (the double top on the H4 chart).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Similar Threads

-

Forex News from InstaForex

By InstaForex Gertrude in forum Advertisement PlaceReplies: 2103Last Post: 16-02-24, 10:27 -

Forex Technical & Market Analysis FXCC

By alayoua in forum Advertisement PlaceReplies: 4Last Post: 07-07-16, 00:25 -

Weekly technical analysis for 3 - 7.12, 2012

By bellalca in forum Affiliate program networksReplies: 0Last Post: 04-12-12, 07:09

Reply With Quote

Reply With Quote

Bookmarks